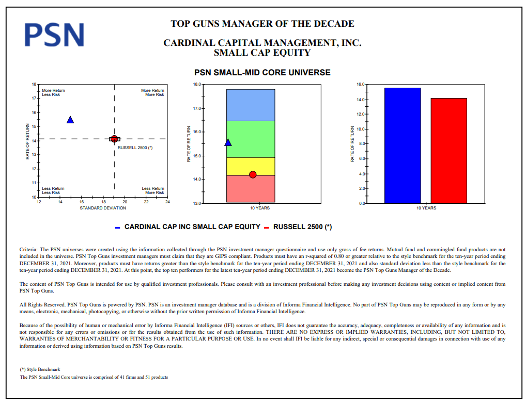

Raleigh, NC—February 18, 2022 — Cardinal Capital Management, Inc. has been awarded PSN Manager of the Decade and Top Guns designations for its Small Cap Core equity portfolio by Informa Financial Intelligence’s PSN manager database, North America’s longest running database of investment managers.

The Manager of the Decade criteria require returns that must be greater than the style benchmark for the ten-year period ending December 31, 2021, and standard deviation less than the style benchmark for the ten-year period ending December 31, 2021. At this point, the top ten performers for the latest ten-year period become the PSN Top Guns Manager of the Decade.

In addition, Cardinal Capital received recognition for its Small Cap Core equity portfolio performance for the fourth quarter of 2021, marking the strategy’s position among the top ten performers for its peer group which includes both U.S. based and non-U.S. based managers and their products.

Cardinal Capital Management’s Small Cap Core equity portfolio is comprised of high-quality small cap companies, generally up to $4 billion in market capitalization at the time of investment, trading at attractive prices. The Small Cap Core equity portfolio seeks long-term capital appreciation with lower volatility in an effort to enhance the portfolio’s overall risk-adjusted returns.

“We are honored to receive this recognition from Informa for our Small Cap Core equity performance over the last decade. This is the third Manager of the Decade award Cardinal has been honored to receive. The previous two awards being for our US Large Cap Core equity portfolio and for our Balanced portfolio performances for the ten-year period ending December 31, 2009. We continue to believe that our disciplined investment approach focused on risk and return is critical to our investors’ long-term success,” said Glenn C. Andrews, CFA, President, and Chief Investment Officer.

“Congratulations to Cardinal Capital Management, Inc. for again being recognized as a PSN Top Gun Manager of the Decade,” said Ryan Nauman, Market Strategist at Informa Financial Intelligence’s Zephyr. “This highly esteemed designation allows us to recognize success, excellence and performance of leading investment managers each quarter.”

The complete list of PSN Top Guns and an overview of the methodology can be located on https://psn.fi.informais.com/

For more details on the methodology behind the PSN Top Guns Rankings or to purchase PSN Top Guns Reports, contact Margaret Tobiasen at Margaret.tobiasen@informa.com

About Cardinal Capital Management, Inc.

Cardinal Capital Management Inc. is an independent registered investment management firm established in 1992, that manages equity, fixed income and balanced assets for U.S. clients. The company’s clients include individuals, trusts, corporations, and foundations. Cardinal Capital Management claims compliance with the Global Investment Performance Standards (GIPS®). A complete list of composite descriptions and compliant presentations are available by calling (919) 532-7500 or contacting Wes Andrews at wandrews@cardinalcapitalmanagement.com. For more information, please visit https://www.cardinalcapitalmanagement.com.

About Informa Investment Solutions

Financial Intelligence, part of the Informa Intelligence Division of Informa plc, is a leading provider of products and services helping financial institutions around the world cut through the noise and take decisive action. Informa Financial Intelligence’s solutions provide unparalleled insight into market opportunity, competitive performance and customer segment behavioral patterns and performance through specialized industry research, intelligence, and insight. IFI’s Zephyr portfolio supports asset allocation, investment analysis, portfolio construction, and client communications that combine to help advisors and portfolio managers retain and grow client relationships. For more information about IFI, visit https://financialintelligence.informa.com. For more information about Zephyr’s PSN Separately Managed Accounts data, visit https://financialintelligence.informa.com/products-and-services/data-analysis-and-tools/psn-sma.

Cardinal Capital Management

Media Contact: Wes Andrews Cardinal Capital Management, Inc.

wandrews@cardinalcapitalmanagement.com

(800) 625-2335

Verification Report

Cardinal Capital Management Disclaimer

Performance results represent composite results for the Small Capitalization strategy managed by Cardinal Capital Management, Inc. (“Cardinal”) during the corresponding time periods. The performance results reflect the reinvestment of dividends and other account earnings, and are net account transaction and custodial charges, and Cardinal’ s investment management fee except for those performance returns that are compared to other similarly benchmarked managers (for example, managers whose performance is compared to the FTSE Russell 2,000 index) in charts which results were prepared utilizing investment managers database and the PSN investment managers database which are reported gross of investment management fees, including Cardinal management fee- (see Gross of Fees disclosure below).

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that future performance will be profitable, or equal either the Cardinal performance results reflected or any corresponding historical benchmark index. FTSE Russell provides float-adjusted, market capitalization weighted indices for a precise picture of the market. FTSE Russell chooses the member companies for the Russell 2,000 based on the market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. The historical performance results of the Russell 2,000 (and those of or all indices) do not reflect the deduction of transaction and custodial charges, nor the deduction of an investment management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. The historical Russell 2,000 performance results (and those of all other indices) are provided exclusively for comparison purposes only, so as to provide general comparative information to assist an individual client or prospective client in determining whether the performance of a Cardinal portfolio meets, or continues to meet, his/her investment objective(s). It should not be assumed that Cardinal account holdings will correspond directly to the Russell 2,000 or any other comparative index. The Cardinal performance results do not reflect the impact of taxes.

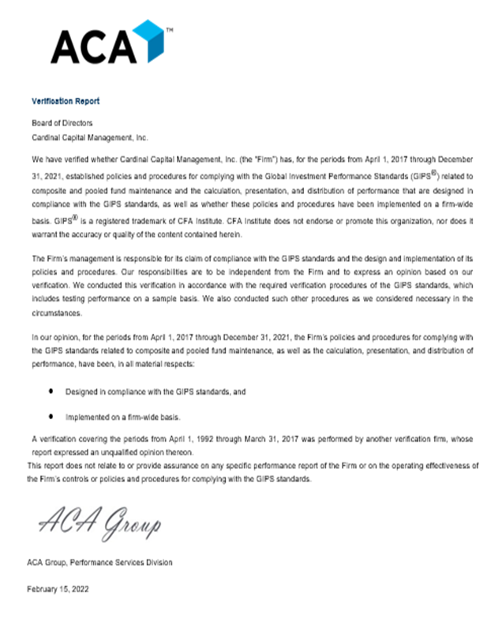

For reasons including variances in portfolio account holdings, variances in the investment management fee incurred, market fluctuation, the date on which a client engaged Cardinal’s investment management services, and account contributions or withdrawals, the performance of a specific client’s account may have varied substantially from the indicated Cardinal portfolio performance results. Cardinal Capital Management’s compliance with the GIPS standards has been verified for the period April 1, 2017 through December 31, 2021 by ACA Performance Services LLC and between the periods April 1, 1992 through March 31, 2017 by Ashland Partners & Company LLP. In addition, a performance examination was conducted on the Small Cap composite beginning December 31, 2010 through December 31, 2021. A copy of the verification report is available upon request. Information pertaining to Cardinal’s advisory operations, services, and fees is set forth in Cardinal’s current disclosure statement a copy of which is available from Cardinal upon request.

Gross of Fees (charts from PSN investment managers database) Comparative managers’ investment performance is shown in these charts gross of their management fees and Cardinal’s investment performance is shown gross of Cardinal’s investment management fees (as described in Cardinal’s written disclosure statement), the incurrence of which will have the effect decreasing the composite performance results (for example: an advisory fee of 1.5% compounded over a 10-year period would reduce a 10% return to an 8.5% annual return).